U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Joe Neguse

(D) Phil Weiser

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) George Stern

(D) A. Gonzalez

(R) Sheri Davis

40%

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

October 28, 2019 02:51 PM UTC

October 28, 2019 02:51 PM UTC 8 Comments

8 Comments

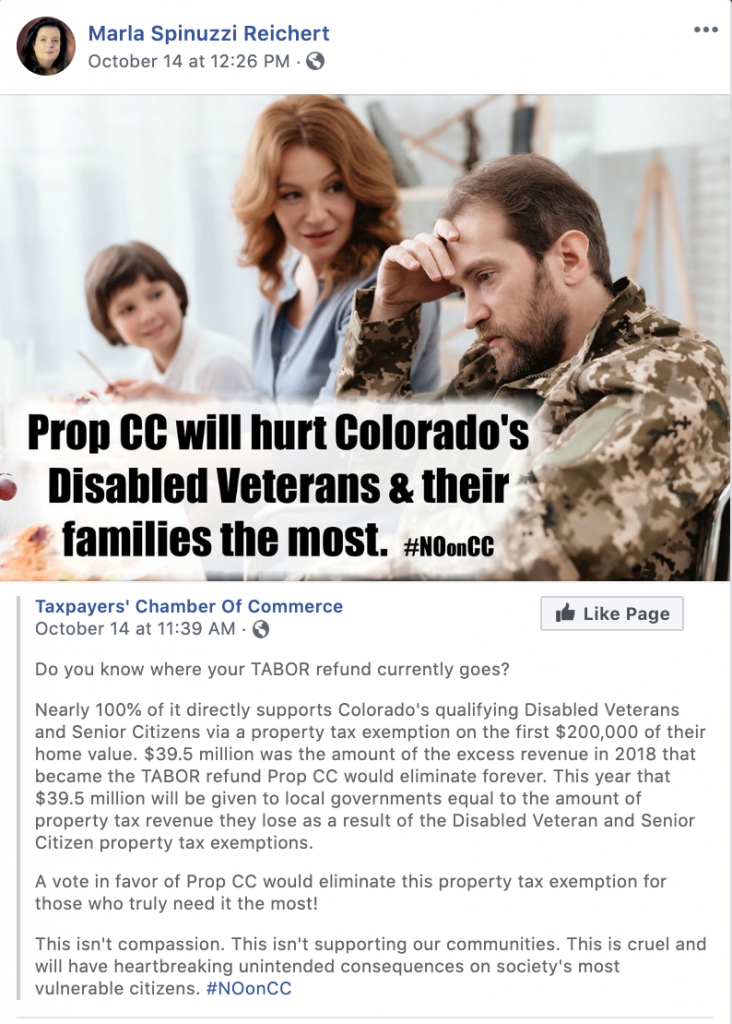

I like that folks are pushing back against the misinformation, but I wish they could do it with a more accurate set of actual information.

While true, this is bullshit. Yes, the homestead exemptions are in the constitution. So's this bit, emphasis mine:

Which means the legislature can reduce (to zero!) the amount of value subject to the senior exemption. In fact, they've done it six times. And, here's the shocker, they do that with a statutory measure just like Proposition CC.

So, while they can still choose to fund the exemption entirely from the General Fund, and well may, because they have before, it doesn't mean they will. Will not having to refund a TABOR surplus be the key to this decision? I think probably not, since they'll likely "funge" some existing transportation or some other money into the retained TABOR excess and keep the exemption in the General Fund, but that's not "no."

P seudo is right. One of the reasons I supported the senior tax credit is that it can be suspended in critical budget years when critical needs like education need the cash. That's a good thing, not a bad thing. But Pseudo is right– it's a thing.

Dude/ette –

Facty truthiness is … so '00's

We want blistering attack

Name calling is good. Somthing that slams a demographic, ostensibly related to the subject, but slyly disparaging a candidate or branch of gov't

A for math.

B- for message.

F for inflamaiton

There is a law, or whatever they call the method used to screw seniors out of a homestead exemption, sitting in a legislative committee. I'm hoping they will not need to proceed with it if prop cc passes.

Frankly, I don't believe in this special tax break for seniors. They are the least impoverishrd group. We donate most of ours to camfed, which educates African girls.

Donating a portion of your tax exemption that you write off as a deductible charitable donation and can then spend with moral superiority . . .

. . . Sweet.

God bless America.

Wrong as usual, Dio. I don't itemize deductions, ergo don't deduct charitable contributions.

Math is hard for you😢

My [in]sincere apologies, V.