President (To Win Colorado)

See Full Big Line

(D) Kamala Harris

(R) Donald Trump

80%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) V. Archuleta

98%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Marshall Dawson

95%

5%

CO-03 (West & Southern CO)

See Full Big Line

(D) Adam Frisch

(R) Jeff Hurd

50%

50%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert

(D) Trisha Calvarese

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank

(D) River Gassen

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) John Fabbricatore

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen

(R) Sergei Matveyuk

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(D) Yadira Caraveo

(R) Gabe Evans

70%↑

30%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

May 06, 2011 01:35 AM UTC

May 06, 2011 01:35 AM UTC 13 Comments

13 Comments

The poor slime. Too bad. May they leave the state unhappy.

Why did Rollie Heath sponsor it? It’s not like he needs campaign contributions from them.

who introduced the last minute amendments in the Senate that added back some payday loan fees to the 45% interest-rate bill that came out of the house. He did that, reportedly, after negotiating a compromise between the lenders and the House version that had passed earlier.

In some sense, Heath helped the cause last year because without his last minute amendments that bill reducing the fees from what they were before and allowing for repayment over six months would not have passed. (Last year’s bill only passed the Senate by one vote with two or three Dems voting against it. The House later adopted the Senate version without revision or reconciliation in order to get the thing into law. The Senate passage and the House adoption of the Senate version came down to, like this year, the last few days of the session.)

Heath said this year that he felt that the Attorney General got the interpretation wrong; that he (Heath) always intended in his amendments for one of the fees (the “origination fee”) to be nonrefundable and fully earned at the time each loan is written. So this year Heath was in a sense keeping his word to the lender’s with the amendments that were nogotiated last year.

I don’t know if one should give him props for honoring what he felt was his commitment and his word, or frown upon his bill this year that would have helped the lenders get back some more fees. (It’s hard to know just how to feel since we rarely find ourselves in the situation of having to judge an elected official for attempting to keep their word even when it’s unpopular to the caucus.)

Anyway, that’s the story as I understand it. I think Awen is more tuned into this than I am, he may have a different view.

I’d like to see a legislator who is committed to Real People, not the lobbyists s/he makes backroom deals with.

But maybe for the same reason he thought Grand Junction and Boulder belong in the same Congressional district.

In other words, because he’s totally out of fucking touch with reality.

Heath has lost a lot of points with me this session.

We need all the women we can get in the state legislature.

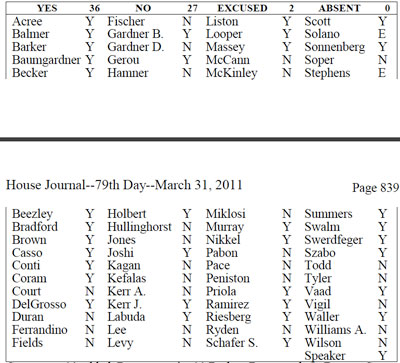

Two of the three Democrats who voted for the Payday bill in the House were women (Sue Schafer and Jeanne Labuda).

we need all the women we can get who won’t vote for less restrictive laws on payday lending in the legislature. Or something.

Germans?

Don’t stop her now . . . she’s on a roll . . .

Colorado was tied for first place with New Hampshire for the highest percentage of women serving in the State House and Senate.

Nifty little map here showing who’s at the bottom of the barrel.

I don’t know why we wouldn’t. But just sayin’.

Again, it’s really not a question, but let’s not forget it.

Or just ones we don’t like today? If Dem women are men, the men have to have a chance of being men.

I don’t the rules of this particular game. 🙁