U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Joe Neguse

(D) Phil Weiser

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) George Stern

(D) A. Gonzalez

(R) Sheri Davis

40%

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

April 25, 2016 08:07 AM UTC

April 25, 2016 08:07 AM UTC 9 Comments

9 Comments

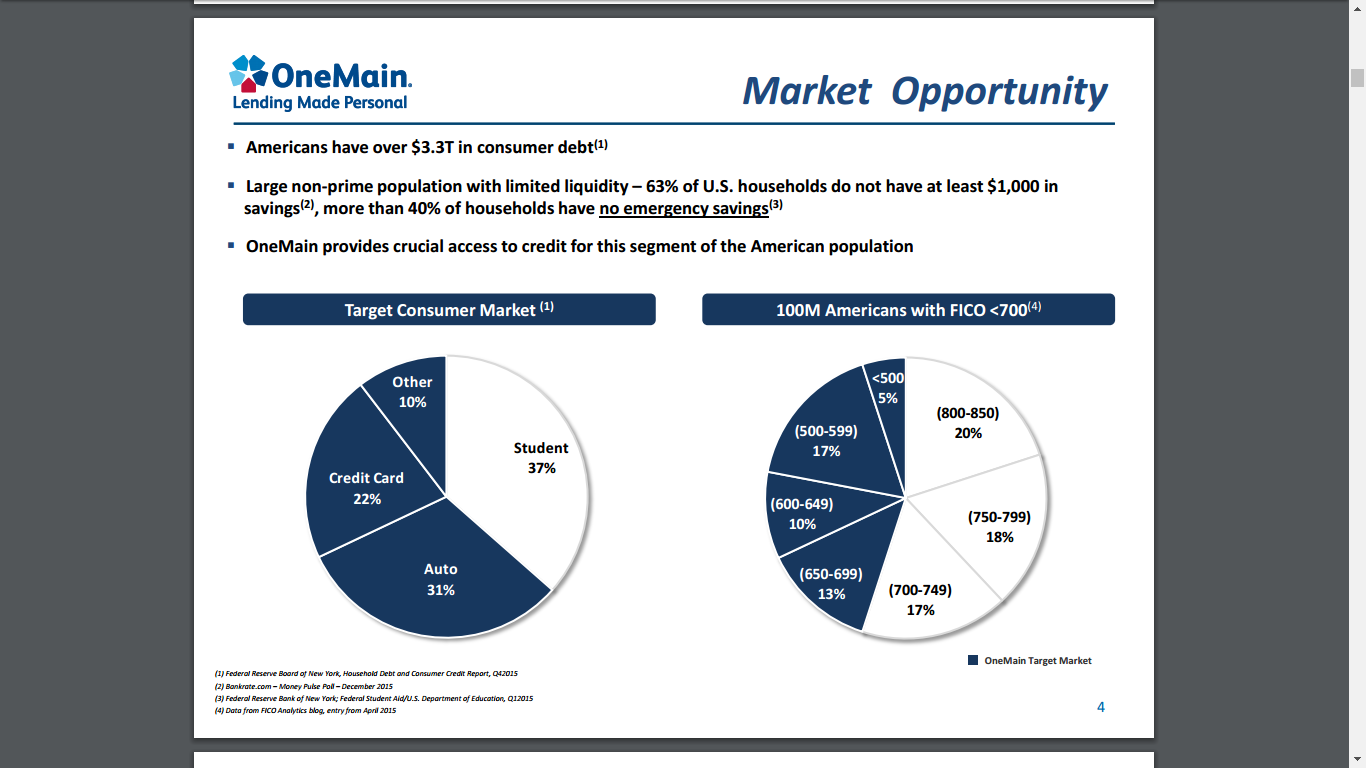

Excellent reporting, Jason. I am not sure the English lexicon contains sufficient adjectives to describe these companies, but we can start with "blood sucking leeches". they are akin to the companies that are running the probation operations in many jurisdictions down south in particular.

These people are disaster capitalists…and they create the disaster by exploiting struggling families and dispossessed people….a pox on them.

Private Probation Services Penalize the Poor, New Report Says …

http://www.nbcnews.com/news/investigations/private-probation-services-penalize-poor-new-report-says-n22411

"Disaster capitalists"? …

How's OneMain supposed to keep keepin' 'em down if our legislators don't keep makin' it easier to keep keepin' em down???

Thanks, Duke. It's hard for a giant financial company to speak to investors and real people at the same time without offending one or the other.

Perhaps reporters should also report that this OneMain Holdings, formerly Springleaf Holdings is the monopoly lender in this market after Springleaf (formerly American General, an AIG company) purchased OneMain (formerly CitiFinancial, a Citigroup company) in 2015 …

… and that both AIG and Citi and their red-headed step children by whatever names they're using — all owe, in large part, the fact if their very existence today to those Great Recession (which they, btw, helped engineer) taxpayer bailouts!

How could it not wind up here…? Well, actually, they probably ("they" being Big Banks and Big Insurance companies) all have a finger in that pie…or a similarly scurrilous one. You know…profit make you do 'bout anything…

You had it more right at "Disaster capitalists" than you realized … as capitalists, they're a hulking disaster ("bail us out, you have to"!) — and, there's no disaster, even those they abet, that they won't capitalize on!!!

So when I read this in the linked Herald article:

Aside from vomiting in my own mouth a little at that "progressive reasons" bit, I felt like I should maybe wonder why Rep. Melton is concerned about losing "that last company" when the only reason we lost "that other company" is that the remaining one bought it out. I'm also curious, because in order to make the merger work, Springleaf entered into a consent decree with the DoJ's Antitrust Division to divest its Colorado offices for acquisition by Lendmark. Did that fall through for some reason? It was scheduled to happen this spring.

I guess one man's "shrinkage" is another man's "conquering, devouring, bloated monster" (have fun with those metaphors …) …

As far as I understand there is a small, token divestiture of an insignificant number of locations (a small handful in Colorado), probably mostly so that the DOJ could have cover from signing off on a 100% merger monopoly (… Hey, 94.7%, we did a good job protecting America here, huh?!?)!

boils, my blood, it does…..