DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

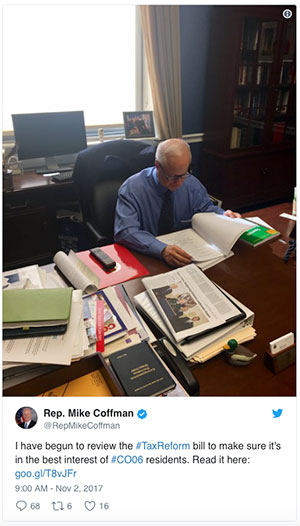

December 06, 2017 10:35 AM UTC

December 06, 2017 10:35 AM UTC 9 Comments

9 Comments

Sad trombone for Robert Murray.

Like Obamacare was drafted any more carefully?? The difference is we're trying to help people with tax relief not ration them with socialized medicine.

Moldy, are you so delusional that you don't even know when you are lying?

Again with the socialized medicine claim.

You do realize that Obamacare was originally Gingrich-care and offered as a market-based solution to Hillary-Care in 1994?

No, I'm pretty sure he's clueless about that, as with most things. He would be shocked if he studied Reagan's words and accomplishments only to realize the former president, a RWNJ in 1980, is a textbook RINO in today's GOP.

It wasn't handwritten in the margin and there were hearings, so yeah, it was more carefully drafted.

Tax relief indeed, Moderatus. Double the standard deductions, then take away the personal exemption, deductions for state & local taxes, medical deductions, etc. Nice try dude. But overall, the bill isn't helping middle and lower class citizens.

Not to mention taxing grad students for the imputed value of their tuition and removing the interest rate deduction on student loans. And of course taxing University endowments.

Apparently there is just too much lernin' going on creating all these fancy-pants smart alecks!