DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

December 19, 2017 02:16 PM UTC

December 19, 2017 02:16 PM UTC 22 Comments

22 Comments

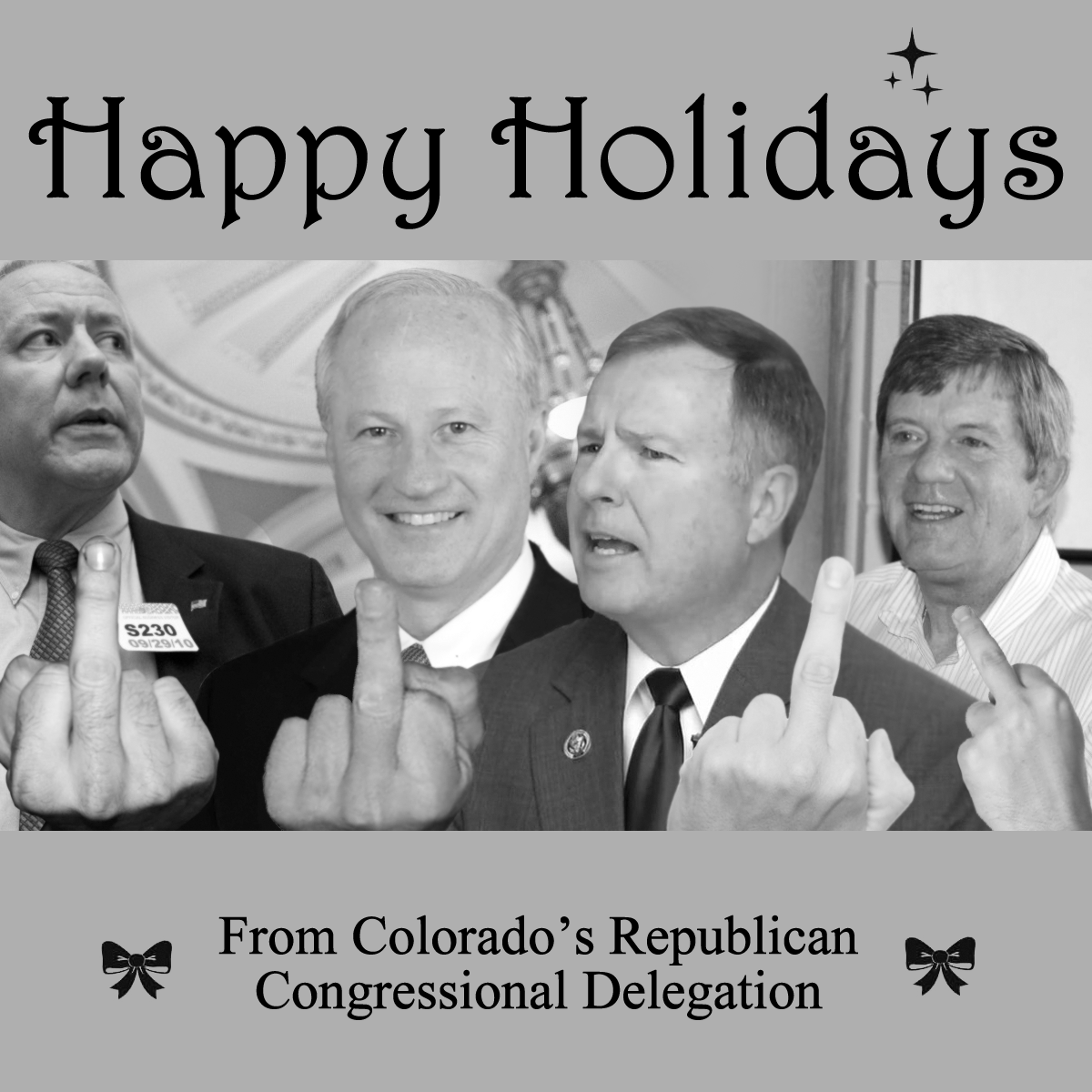

Kiss that House majority goodbye.

Mike Coffman, we're coming for you in 2018.

Vulgarity means you're losing…..

Quick, Moddy…..Grab that box of Kleenexes. Your tax cuts are coming!

I guess there will be more vulgarity from Republican circles next fall.

Btw, speaking of losing, have you heard that a recount in Virginia looks like it caused Republicans to lose a 16th seat in the House of Delegates there? And with it, they lose their majority in that chamber? Republican leaders have conceded the seat.

How sweet it is. Here's to hundreds more state leg seats in November!

I saw that. One vote

It wasn't Danica Roem's seat, was it?

Now who's the snowflake?

E.J. Dionne in the Washington Post sums it up this way:

On second thought if they're giving the finger to the liberals who have lied about this bill from the beginning, great! In two years the people will see the proof in their paychecks and your lies will be over.

And in 10 years, they will be able to count the money they save in negative numbers. But, hey deficits stopped mattering on 1/20/17. Right nutlid? Also, what's with them having to go back to revote because it violated Senate rules? If it's such a great bill, why do they have to re-do because of their amateur mistakes?

So the Christian Sharia law provision (ie. Personhood language) got yanked as well as the punitive tax on librul colleges.

Thank God for small favors — the right wing jihadists will have to find another bill to piss on

So the zygotes and embryos – remember, we cannot use the word "fetus" – will not be able to have college savings accounts?

Don't know if that got pulled; someone snuck in a further expansion of the 529 program to cover homeschooling, and altering the scope that much was a step too far to fit in as a tax provision.

You should talk to some Kansans and see how swell things are over in red meat land.

Maybe he could move there.

CEO’s and Corporate Boards are required BY LAW to pass maximum profits to shareholders and will most likely buy back stock before hiring new workers, investing in the business, or repatriating any of those profits.

https://www.marketplace.org/2017/12/19/economy/corporate-tax-cuts-could-boost-shareholders-balance-sheets

That’s their “fiduciary duty” and they’ll be fired or sued if they don’t.

Moldy, unless you are a multimillionaire (yeah, right), read 'em and weep:

Whatever happened to having to vote on the committee bill without any changes or lose reconciliation status?

Whatever happened to a process deliberative enough that the text could have been cleared first? (Whatever happened to conference committees where both sides had representation?)

Republicans will eventually have House and Senate vote on a bill that conforms to Senate's Byrd rules — probably completed tomorrow or Thursday at the latest. As to what happened to the process… it got hijacked because they have majorities and enough carrots, sticks and promises of fairy dust to keep their majorities solid enough to win.

Where's Waldo?

https://www.nytimes.com/2017/12/19/us/politics/tax-bill-vote-congress.html?action=click&contentCollection=Politics&module=RelatedCoverage®ion=EndOfArticle&pgtype=article

Look at this photo of the Senate GOP leadership. There are a woman, a man behind her who is obviously not Cory Gardner, Tim Scott, Ted Cruz, John Thune, the head of a man (most likely Orrin Hatch), Yertle, John Barrasso, Dean Heller, Cornyn, Roy Blunt, the head of another man who is probably not Gardner, and Lisa Murkowski.

Where is the chair of the RNSC? Did he not want to be photographed with the bridge crew of the Titanic? Not everything Gardner does is evil.