DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%↑

30%

20%↓

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%↑

30%

20%↓

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

January 18, 2019 11:55 AM UTC

January 18, 2019 11:55 AM UTC 3 Comments

3 Comments

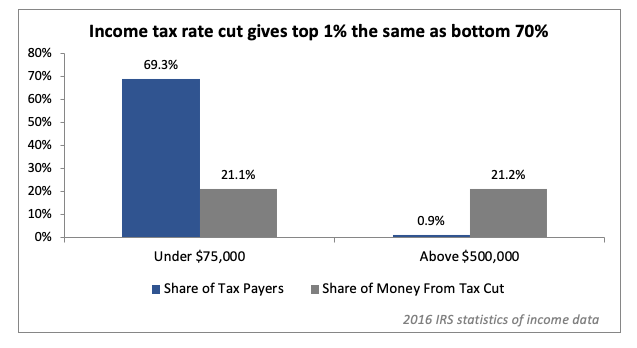

No shit. Because of how income tax is set up, it heavily favors the rich paying over the poor paying.

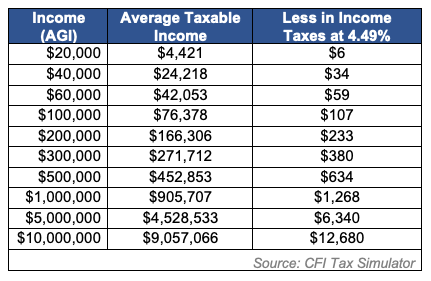

Wow! I am spending

myour $60 on wine. See you on the patio.I'll spend my $6 on, uh… Maybe some soda? Idk.