U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Phil Weiser

(D) Joe Neguse

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) A. Gonzalez

(D) George Stern

(R) Sheri Davis

50%↑

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

January 28, 2019 04:20 PM UTC

January 28, 2019 04:20 PM UTC 3 Comments

3 Comments

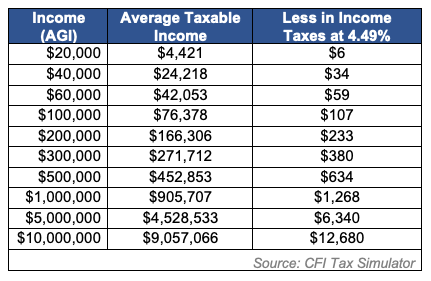

With Nutters two-income family (thanks to the generosity of the US taxpayer) just what is he doing with his extra dollar-a-day???

This would be awesome.

It would give me an extra $1.37/week to spend on wine. Woo-hoo.

I think that the Dimocrats should lower the tax rate. From 4.69% to 4.685%.

This way they can claim: “We lowered your taxes” and cut the issue out from under the GOPers.

It was never about us.

It was always about stock buybacks. (ask I'll elaborate)

Trump Organization and it's rich guy friends need predictible market volatility on a virtually guaranteed upward trend. 2017 and 1-3Q 18. Then they needed a big buying opportunity (dip)

Later, the recession, bank failures and bailouts.