U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Joe Neguse

(D) Phil Weiser

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) George Stern

(D) A. Gonzalez

(R) Sheri Davis

40%

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

October 20, 2019 10:00 AM UTC

October 20, 2019 10:00 AM UTC 27 Comments

27 Comments

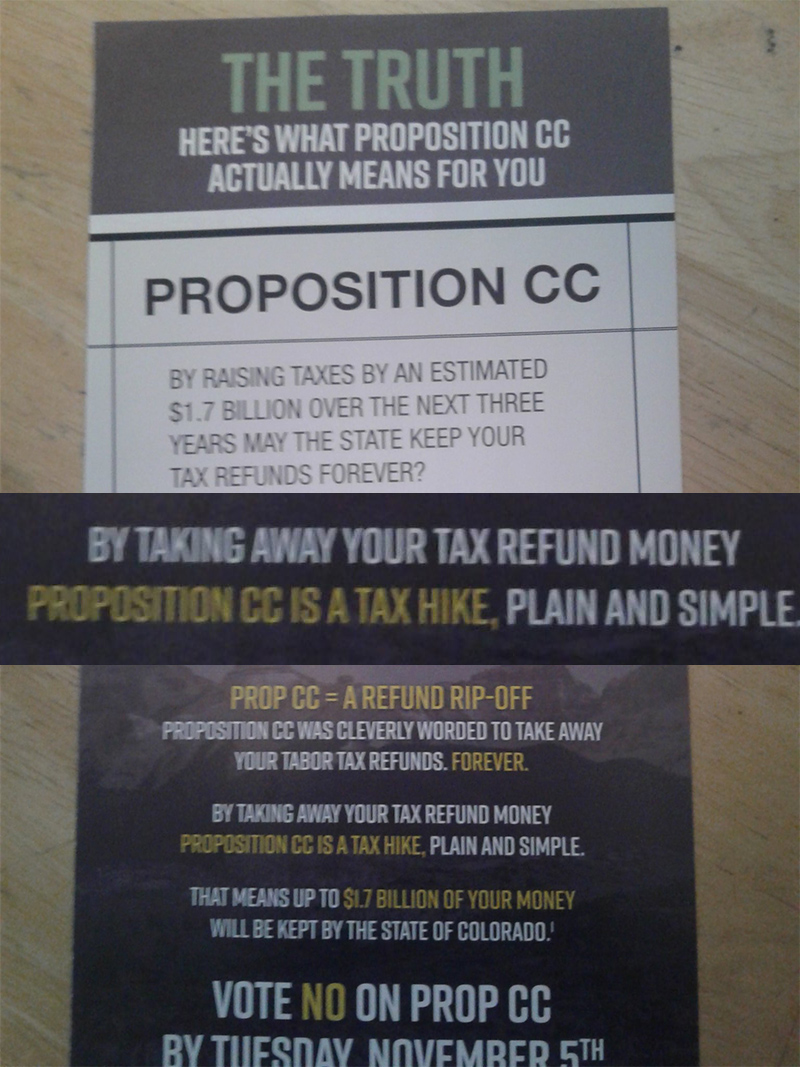

if it is not a tax refund then it is a tax increase

Republicans would know. They raised my taxes with their tax breaks for the 1% bill of 2017.

This is gonna blow your mind, but next year, it's mostly not a tax decrease, not not a refund.

So, ummm, please do tell us which of the taxes that you pay you think are going to be increased by CC, bright guy?

In Trump-speak, Dio, Bright Bart translates to Dim Bulb. These guys worship incandescent light 💡 bulbs and cant understand why we stopped hunting sperm whales for oil. Don’t even think about getting get them started on the brilliance of Arthur Laffer.

Vacuous one-liners: the idiot wingnut's stock in trade. This one delivers in a big way. For instance, since my Johnson is not a tax refund, it necessarily follows that my Johnson is a tax increase.

If your Johnson is a tax increase, then TABOR is a condom?

If TABOR is a condom how do you explain Fluffy?

Ask Genghis for an explanation. It's his Johnson!

I’m just guessing here, . . .

. . .but I suspect that stuffing a condom with kleenex probably is not recommended as a way to help lower the failure rate??? . . .

Ain't no explaining Fluffy. Much like what's inside the event horizon of a black hole, our current physics is inadequate to analyze something that dense.

For 14 years you've only gotten a TABOR refund ONCE.

By the way, it's fair to note that Pols' information is also a bit misleading.

TABOR is a complicated beast, and the machinations that the legislature have gone through to thwart it are at least as complicated. There have been a series of measures designed to make "refunds" in a way that prevents actually directly refunding much. When Pols says "the average 'payout' ranged from $13 to $41," that's partially true, but devoid of the context necessary to describe what actually happened (or will happen next year, absent CC). That $13 to $41 amount is only the "sales tax refund" portion of the overall TABOR rebate scheme.

At the time of the 2015 tax year refund, the legislature had created a TABOR rebate scheme that funded an earned income tax credit for low-income taxpayers (it became permanent, which pulled it from the TABOR realm, the following year). So, folks who received that got, on average, $217 in addition to the $13-ish dollars from the "sales tax rebate." That credit was more than half of the total amount "rebated."

This go around, the rebate scheme includes funding the senior tax exemption (normally funded out of general revenue, or not, as the legislature decides) which was put into the TABOR refund pipeline by the SB-267 omnibus bill, and a temporary income tax reduction, also put in place by the legislature. Only then is money actually sent to people via the sales tax rebate.

In 2020 (tax year 2019), the following are components of the TABOR "rebate:"

– Funding of the senior tax exemption ($600-700-ish for any house over $200,000 in value, less if lower –> about a third

– An income tax rate reduction from 4.63 to 4.50 (from $10 to $629, depending on income) –> almost all the rest of the "rebate"

– A sales tax rebate (based on income reported on the state income tax form and paid through that process), which will average about 50 cents –> a tiny piece of the rebate

I can't remember if there's currently a lawsuit pending on the senior exemption piece, but there surely will be once the government tries to make a "refund" using it.

Wait a minute, I was there in 2013 in I'm pretty sure the law making the state EITC permanent was passed that year. 2015 revenues may have triggered it but the point was to not have poor working folks live or die based on a TABOR cap. That's why it's permanent.

Don't worry, I'm not important enough to have just outed myself. 🙂

You are correct, uhm, Mr. Bullshit. The legislation creating a permanent state EITC was Senate Bill 13-001, signed by Gov. Hickenlooper on June 5, 2013. This legislation changed the EITC from an as-available TABOR refund to a permanent credit, more or less for the reasons you stated.

That's what I thought, thanks Guvs! Senate Bill 1 even. I knew it was a big deal, and I remembered that making the EITC permanent instead of a TABOR handout was the whole point. Helping working families shouldn't be a "rebate scheme," it should be a priority.

Getting back to the main point: how is this as big a deal as telling voters Prop CC will "take their tax refunds?"

It didn't. It was a trigger bill. Literally, that's what the statute section is called:

39-22-123.5. Earned income tax credit – not a refund of excess state revenues – trigger – legislative declaration

If we’d never gone over the TABOR cap by enough to trigger the EITC, there wouldn’t be one.

There was a bill passed in 2013 that said that once the TABOR threshold resulted in the state EITC being offered, the EITC would become a general obligation going forward, not subject to whether revenue was above the TABOR cap.

That was triggered for the 2015 tax year, which caused the credit to become permanent, which pulled it from the TABOR realm, since it was now no longer a "refund" mechanism, from the following year on.

Sorry friend, but the fact that this was passed two years before, which you didn't mention in your original post, undercuts your argument, which seems like a nit picky argument to begin with.

Do you really think this is on the same level as telling people they're going to lose their tax refunds?

You mean this, "it became permanent, which pulled it from the TABOR realm, the following year?" How do you believe that's not what happened?

As far as being nitpicky. In a diary about how terms are being misused and circumstances being disingenuously construed, isn't that the point?

Right on. You're a no vote on Prop CC, you're trolling, and this all makes sense now.

Tell the no on CC campaign to stop lying about people's tax refunds, okay?

I'm voting for CC, as I would to repeal TABOR in its entirety. I've expressed my negative feelings about TABOR repeatedly here.

But, since that's what you have left, sure. CC BAD TABOR GOOD.

Good for you. Sometimes my troll radar is a bit off, usually not though.

Sudafed is not in my fan club. But he does his homework and knows TABOR as the fraud it is. I respect his depth of knowledge.

You're right, he's legit and he's obvs been around the block. I just remember the bill in 2013 distinctly so I knew he wasn't completely right about it happening "after 2015." This seems partly to be a matter of interpretation, and since I hate TABOR I'm all about fucking TABOR. 🙂

Good talk…

And Con man Cory posted his opposition with the same lies. Naturally.