DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

May 05, 2020 10:00 AM UTC

May 05, 2020 10:00 AM UTC 6 Comments

6 Comments

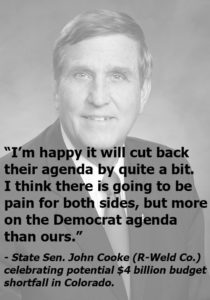

This is the only thing Republicans are excited about now.

Hell, just wait til’ the ol’ Tabor ratchet gets really rollin’ . . .

“only thing Republicans are excited about…..” So, you think that only Republicans make use of the senior exemption on property taxes?

Maybe losing the Homestead exemption will be enough to turn out older voters to repeal TABOR. It might be worth a try.

Regarding TABOR, I voted against it. Determining taxes is the responsibility of elected officials. If one doesn't like what elected officials do, vote them out. TABOR is bad government at work.

It weakens the republican form of government. In fact, it is what we are not supposed to have – direct democracy