U.S. Senate

See Full Big Line

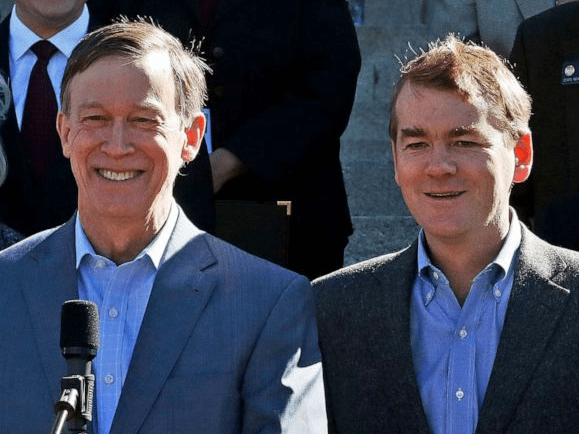

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Joe Neguse

(D) Phil Weiser

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) George Stern

(D) A. Gonzalez

(R) Sheri Davis

40%

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

August 16, 2022 03:38 PM UTC

August 16, 2022 03:38 PM UTC 14 Comments

14 Comments

Congratulations liberals. You broke the Senate but passed your spending bill.

In a few years when the IRS stormtroopers show up at your door but your prescription drugs are no cheaper and climate change no closer to a solution because China doesn't care how much we spend, will you finally admit you were wrong about everything?

"Congratulations liberals. You broke the Senate but passed your spending bill."

HEHEHEHEHEHEHE

Liberals broke the Senate. You never cease to make us laugh, Moddy.

Given the people Moddy associates with, he probably does have a valid reason to fear IRS enforcement of tax laws

Lulz. What a putz.

Well, I can tell you who is at fault for insulin still being expensive. Their your heroes. Kept the Insulin price cap of $35 out of this bill.

And if climate change is no closer to a solution, then it's because y'all insist on "drill baby drill" and hate renewable energy.

Here's the thing if we're wrong about everything, you're MORE wrong. I'll take my chances with the party that does NOT want to turn us into a theocracy. Such as a functionally illiterate moron suggesting a "Biblical literacy test". I'd take being the party of Biden over the party of Boebert every day.

Moldy here is yet another

republicanfascist that is detached from reality.Passing the IRA via reconciliation is completely within the senate rules you putz.

FYI, it was Moscow Mitch and the

republicansfascists that broke the senate.This is dumb even for you, Moddy.

More Moddy moldy mantra.

IRS stormtroopers at my door … yeah, that's pretty funny, as few of the IRS personnel slated to be hired are going to be doing enforcement. IRS Commissioner Charles Rettig said the resources won’t increase “audit scrutiny on small businesses or middle-income Americans.”

In the course of the debate, one Senator suggested NOT ONE of the new hires will be devoted to households with incomes under $400,000 a year. Enforcement personnel will be augmented for corporations and the wealthy — current stats suggest "those making $400,000 or more in income belong to a rarified group. They represent the top 1.8% of taxpayers" (and about 25% of the income).

That will push the IRS back to where it was about 10 years ago —

And also in the course of debate … the new hires are expected to cut hold times for callers substantially. For the 2022 tax season, "When you call the IRS, prepare to wait. And wait. And wait. You can make some coffee and even do a load of laundry while on hold. The average time a taxpayer spent waiting on hold increased from 20 minutes to 29 minutes, Collins said in her report. But that doesn’t capture the many people who just gave up and hung up." About 9 in 10 calls were abandoned before a human answered. Some of those no doubt were also using a search and found internet resources to answer their question. Some may have had their questions answered by the recorded advice.

I worked with a company concerned about callers seeking assistance not getting to a human in a minute, and not getting to even the most sophisticated level of support within 2 calls and a combined on-phone time of 10 minutes. Front line abandon rates of 5% for a week or more brought LOTS of attention from executives.

IRS needs more people, better technology, and better priorities. They don't have and won't have stormtroopers.

With all the added funding for the IRS, maybe they can finally complete that perpetual audit that purportedly kept former President Trump from releasing his 2016 tax returns. (Said with heavy sarcasm)

As someone who pays a lot of taxes – damn right I want better enforcement of the rich. I have no tax shelters, etc. and keep my taxes as simple as possible. It’s clean and I pay my fair share.

And I’d love to see others who make as much as I do and more also pay their fair share. It’s bullshit that many of the rich unfairly avoid paying their fair share.

Agreed. I had the IRS audit me about 15 years ago. It was unpleasant, but the appeals agent was a reasonable, decent person that I could work with to resolve a difficult situation.

The Clown Prince of Pennsylvania Avenue is getting skewered in today’s NYT