President (To Win Colorado)

See Full Big Line

(D) Kamala Harris

(R) Donald Trump

80%↑

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) V. Archuleta

98%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Marshall Dawson

95%

5%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd

(D) Adam Frisch

50%

50%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert

(D) Trisha Calvarese

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank

(D) River Gassen

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) John Fabbricatore

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen

(R) Sergei Matveyuk

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(D) Yadira Caraveo

(R) Gabe Evans

52%↑

48%↓

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

February 08, 2023 12:39 PM UTC

February 08, 2023 12:39 PM UTC 3 Comments

3 Comments

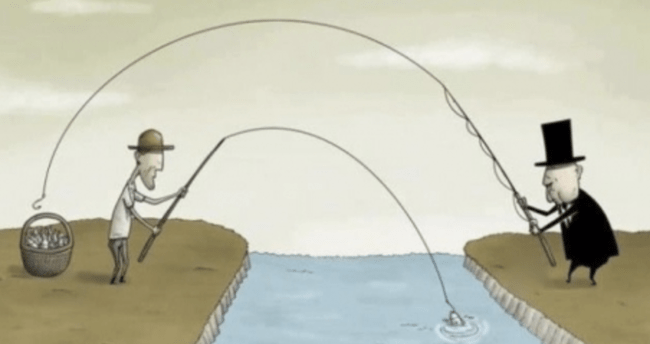

Gahhh! The fiscal note said 1063 would cut $2.7 billion from the General Fund in its first full year. Just spitballing here, but that might represent give or take 20% of the General Fund, depending on actual economic performance. I will assume Bottoms did not specify what services or programs would need to be slashed if 1063 passed.

Who is General Fund, and why does he have so much money?

He is one of the Generals gathered in their masses…