DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%↑

30%

20%↓

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%↑

30%

20%↓

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

March 14, 2023 12:37 PM UTC

March 14, 2023 12:37 PM UTC 11 Comments

11 Comments

As I said in response to the Kia Challenge blog, everything is Jared Polis' fault.

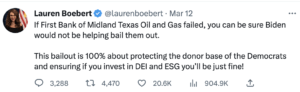

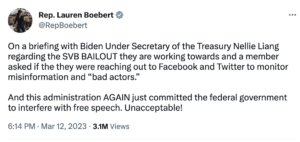

Why I love Woke Banks

Did the Banks ‘Go Woke’ or Just Enjoy Bipartisan Deregulation?

Anytime someone says the word "woke" in a derogatory sense, my eyes immediately want to roll into the back of my head and my brain stops responding to any input from that person.

It's safer for all involved really.

Look at the bright side: Babushka Boebert has at least stopped yapping about gas stoves?

I love the "woke bank" argument, which says that the bank failed because it invested in "woke" securities that failed it. SVB failed because it had too much money tied up in pre-inflation long-term Treasury bonds. Very woke indeed, our government bonds…

Unfortunately, Colorado's "Democratic" corporate senator Michael Bennet (and always well spoken of by Colorado Pols) voted AGAINST Dodd-Frank back in 2010. He also voted for Trump's weakening of it in 2018. Sure wish we had a senator from our supposedly deep blue state who had Deep Blue values, instead Bennet is highly corporate aligned.

The 2018 roll-back of Dodd Frank provisions is considered a huge part of the reason for the recent bank failures. The CEO of SVB was a lobbyist for that rollback. Received nearly $10mm in compensation last year.

Feel free to make that argument in 2028, when Bennet is again up for re-election.

Who do you suggest?

The beauty of the FDIC is it is a government invention. It was voluntary and so logical practically all banks opted in.

Like the secondary mortgage market. The internet.

The impact of fractional reserve banking was and still huge. But it comes with risk.

The leadership of SVB blew it. Not the depositors. Unless you want every consumer to individuize underwriting – effectively eliminating banks- the leaders need punishment and continued oversight. Payback the depositors with shareholders value and wealth.

Spot on. Especially since the executives received huge bonuses hours before SVB went *SPLAT*. Those bonuses need to reimburse the FDIC for the accounts it will have to pay out on:

https://thehill.com/homenews/senate/3900613-tester-tells-fed-to-claw-back-bonuses-from-silicon-valley-bank-execs/