U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(R) Somebody

80%

20%

Governor

See Full Big Line

(D) Joe Neguse

(D) Phil Weiser

(D) Jena Griswold

60%

60%

40%↓

Att. General

See Full Big Line

(D) M. Dougherty

(D) Alexis King

(D) Brian Mason

40%

40%

30%

Sec. of State

See Full Big Line

(D) George Stern

(D) A. Gonzalez

(R) Sheri Davis

40%

40%

30%

State Treasurer

See Full Big Line

(D) Brianna Titone

(R) Kevin Grantham

(D) Jerry DiTullio

60%

30%

20%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(R) Somebody

90%

2%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Somebody

80%

40%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) Somebody

90%

10%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Somebody

80%

20%

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

10%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

10%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Yadira Caraveo

(D) Joe Salazar

50%

40%

40%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

October 11, 2023 10:44 AM UTC

October 11, 2023 10:44 AM UTC 5 Comments

5 Comments

I feel seen.

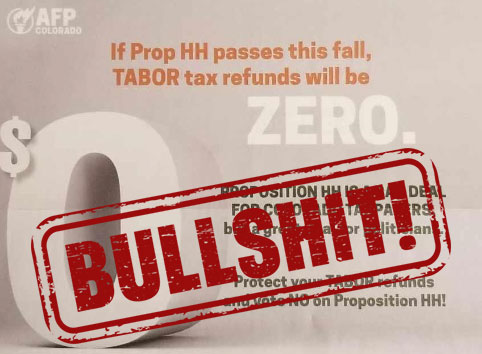

For RWNJs and their billionaire patrons, the truth never seems to work in their favor. So apparently their only option is to lie their faces off.

The anti-HH stuff is utter horseshit, of course, but lies do pretty damn well in the contemporary good ol' US of A. The anti-HH ads I've seen on YouTube are bullshit, but definitive, well-produced, to the point, and abundant. The pro-HH ads on the same platform state the truth, but are few, far between, and presented as animals speaking in funny voices. Makes it look like an AFP-generated parody ad.

I have not seen a single pro-HH advertisement. I know they are out there, but it seems to me that the anti-HH perspective is dominating this debate, whether or not its advocates are being straight with the public or not.

And I believe that the underlying worry among the public about large property tax increases is also something that has so far been generally underestimated. I would wager that, if an initiative that proposes a tight annual cap on property tax increases makes the 2024 ballot, it will pass with at least 2/3 of the statewide vote.