DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

(D) J. Hickenlooper*

(R) Somebody

80%

20%

(D) M. Dougherty

(D) Jena Griswold

60%↑

40%↑

(D) Brianna Titone

(D) Jeff Bridges

(R) Kevin Grantham

40%

40%

30%

(D) Diana DeGette*

(R) Somebody

90%

2%

(D) Joe Neguse*

(R) Somebody

90%

2%

(R) Jeff Hurd*

(D) Somebody

80%

40%

(R) Lauren Boebert*

(D) Somebody

90%

10%

(R) Jeff Crank*

(D) Somebody

80%

20%

(D) Jason Crow*

(R) Somebody

90%

10%

(D) B. Pettersen*

(R) Somebody

90%

10%

(R) Gabe Evans*

(D) Manny Rutinel

(D) Yadira Caraveo

45%↓

40%↑

30%

DEMOCRATS

REPUBLICANS

80%

20%

DEMOCRATS

REPUBLICANS

95%

5%

August 15, 2024 10:45 AM UTC

August 15, 2024 10:45 AM UTC 7 Comments

7 Comments

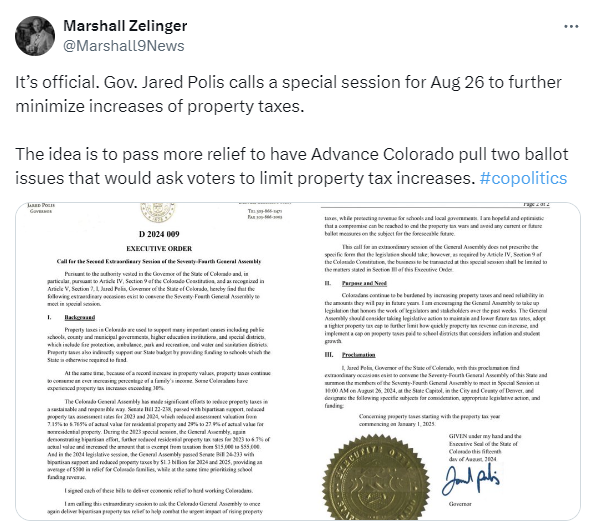

For the second time in less than a year, Colorado legislators will be called into a special legislative session to discuss property taxes. But unlike the special legislative session that took place

For the second time in less than a year, Colorado legislators will be called into a special legislative session to discuss property taxes. But unlike the special legislative session that took place

Why should anyone believe that they'll pull the measures this time either after they get even more in ransom? They don't care about the consequences of their actions. People like this do not deal in good faith, they have to be defeated.

In the special session, the legislature ought to set up the mechanisms necessary if the measures pass — clarify the sequence of ALL the oxen getting gored, outlining rules of priority among different sorts of taxing districts. The more specific they can be, the more voters can understand what disasters will occur.

Unfortunately being clear about the consequences of terrible decisions like TABOR still didn't penetrate the minds of most voters who continue to prioritize their own ignorance and selfishness above understanding of fiscal policy.

Governor Polis should not call a special session. Besides the indignation over the immoral and unethical behavior of Advance Colorado and Colorado Concern, there is good reason to call their bluff and fight them until we win in November. The polling data shows that one of the initiatives has the support of 38% of the voters and the other one has only 36%. Neither one has a chance of passing in November. At this stage of the campaign cycle, an initiative that has less than 50% support never passes in the general election. Mr. Fields came back to the negotiating table because he knows how far in the hole his initiatives are and that it isn’t going to get better as the campaign proceeds. He knows he will lose in November.

Everyone should keep the long term perspective in mind. Mr. Fields and his ilk, including the Republican Party, do not care about our state or its government. In fact, they do not care about property taxes. The property tax issue is merely a convenient facade for their real objectives. Their long term objective is to cripple the government by reducing tax revenues. When they accomplish that and the state government flounders, they will return with the mantra that see we told you the government doesn’t work (even though they are the ones that insured it would not work) and because it doesn’t, we need to cut taxes and programs even more. If you ask Mr. Fields or the Republicans what government programs they would keep and fund, they will say that is up to the legislature. They will never give you a specific answer because to do so means they would have to engage in substantive discussions about the value of government and to them, government has no value. Mr. Fields and his allies are not conservatives. They are radical extremists who subscribe to the myopic view that the government is to blame for all the ills of society and their solution is to leave society without the means to address those problems. We should never pay ransom to those people.

Always well said Republican 36. Don't grant powers to Fields and Davia that they don't even have.

If Polis calls a special session, he’s signaling that wealthy interests can get what they want by running an initiative and never even having to put it to the vote of the people.

The better way to go is to let these ballot measures proceed.

Polis' calculus

Call the special section. Wash your hands. Let the lege take the rap. Follow "the will of the people" if the deal is betrayed and the measures go to ballot anyway.