November 06, 2013 11:51 AM UTC

November 06, 2013 11:51 AM UTC

The Colorado Independent's Shelby Kinney-Lang reports on the statewide tax measure that did pass yesterday in Colorado:

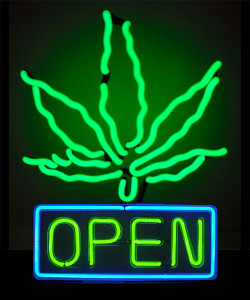

Coloradans on Tuesday passed a meaty statewide sin tax on pot in Proposition AA, handing a windfall to the state’s emerging marijuana regulatory regime and some yet-to be determined amount to local school budgets.

The first $40 million taken in will be set aside for the state’s BEST school construction grant program, which can be used to build new schools or improve existing school buildings. That’s the only money to be generated from Proposition AA promised to a specific program, according to state regulators at the Department of Revenue, which oversees the Marijuana Enforcement Division.

“If there is additional revenue, it has to be appropriated by the General Assembly, which can be for the regulatory structure, as well as related costs for health, education and public safety,” Daria Serna, communications director at the Department of Revenue, told the Independent in an email…

[B]ecause HB 13-1317 is not constitutional, there are no strong rules governing the revenue, which means the legislature, after funding the new enforcement division, will use the Marijuana Cash Fund as it likes. [Pols emphasis]

A major unknown question is what the actual cost of regulating the commercial sale of marijuana will be. There's a good possibility that the regulatory regime won't cost anywhere near the amount Proposition AA will collect. After a suitable period cautiously banking those excesses, it's entirely likely that marijuana taxes will provide a revenue stream above and beyond the current stated purposes of school construction grants and regulation of the industry.

We've said repeatedly that a major factor in voter approval of 2012's Amendment 64 legalizing marijuana was the opportunity for a new and robust tax revenue source. The extremely high profit margins for medical marijuana presently sold in Colorado strongly suggest these taxes can be absorbed in the market price of the product. If that's true, concern about driving consumers "back to the back market" will quickly prove unfounded.

Beyond the larger issues of justice and harm reduction, it's the money that will make commercialized marijuana a success in Colorado. Money to be made, and to be taxed. It's worth remembering that House Bill 13-1318, which referred Proposition AA to the ballot, passed the Colorado House on a party-line vote. In an election short on victories, this is a win Democrats can at least partly console themselves with today.

Subscribe to our monthly newsletter to stay in the loop with regular updates!

Comments